Banks are concerned with delivering positive experiences to their customers and employees. The Toronto firm Shikatani Lacroix Design (SLD) conducted an extensive study to discover what would increase banking ROX (Return On eXperience). Thank you to the Herman Trend Alert for summarizing their key findings.

In order to grow and thrive, banks need to:

Track ROX

The SLD survey found a strong correlation between the measurement and understanding of ROX and growth. Institutions that grew 10 percent or higher in the past three years were tracking ROX at a higher level (67 percent versus 52 percent).

Provide and Measure What Banking Customers Value Most

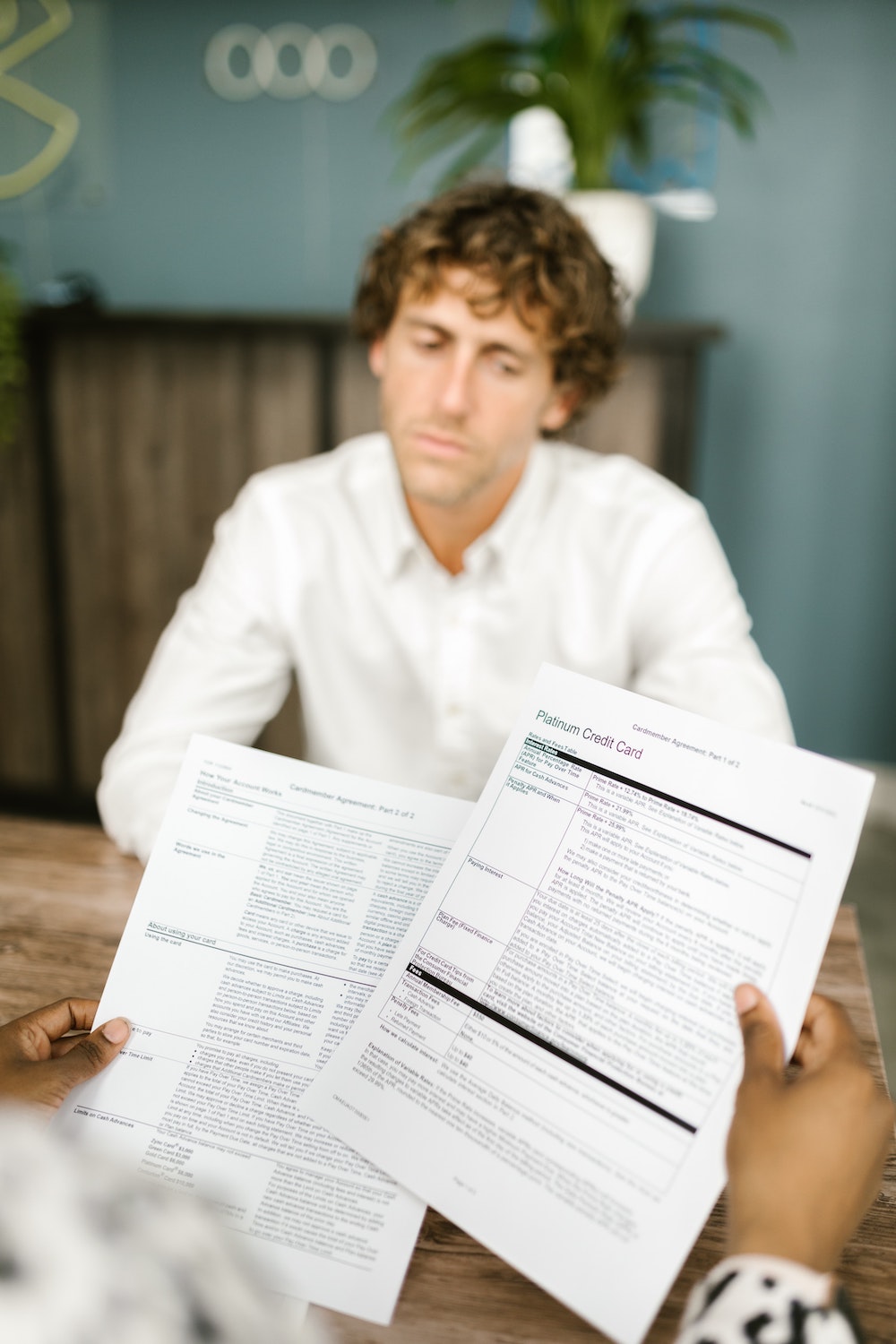

This research revealed a significant gap between what a successful banking experience means to customers and bank executives. While the banks are focused on profits, consumers really want them to be customer-centric. For example, customers said banks are not meeting their expectations for financial advice; not surprisingly, assessment of advice is not a top metric for executives. Tracking ROX is financially driven for bankers, while consumers define their ROX by ease of doing business, excellent customer service, and engaged and helpful staff. There is a critical lack of emphasis on the human side of banking like ease and speed of transactions, level of expertise, and level of attentiveness to and understanding their needs.

Keep Up With the Wants and Needs of Key Stakeholder Groups

Bank executives need to pay attention to the perceptions of their employees and customers. Unfortunately, most banks are so focused on their own bottom lines that they overlook what is important to their primary stakeholders. What they do not realize is that, in engaging these and all their stakeholder groups at deeper levels, they will drive greater profits. Unless bankers change with the times and keep up with the shifts in values and attitudes of employers and customers, they will continue to lose billions in profits.

Training is the Answer

Ultimately, excellent customer service and engaged and helpful staff depend on managers who have the knowledge and skills to manage effectively, support continued professional development opportunities for staff, maintain a positive work environment, and advocate for the systems and resources that enable their staff to be successful.

Contact Deborah Laurel of The Peer Learning Institute to learn how to ensure that your managers have the skills they need so employee and customer ROX is high.

#bankinggrowth #whatbankcustomerswant #successfulbankingexperience